Which UK-based private healthcare providers are running away with their digital presence and who needs a helping hand to take the next step? How is private healthcare perceived by the general public? Find out more.

How much Does The UK Spend on Private Healthcare?

UK residents may have exposing views when it comes to our healthcare, but there’s no denying the data for the cost of healthcare expenditure in the UK, which was over £280 billion in 2022 alone — over 3.5 times more than in 2000. And this figure is expected to rise.

While £280 billion is an unfathomable amount of money, this figure doesn’t include UK residents who opt for private healthcare — with costs at £46.4 billion in 2022 — an increase of nearly £4 billion from 2011.

Let’s unravel the data surrounding private healthcare — including the mean annual cost, why UK residents register in the first place, the demographics, and more.

Would Brits Pay For Private Healthcare?

A whopping 47% of respondents in the UK would be unlikely to pay for private healthcare or health insurance if they needed it. 23% of respondents said they’d be likely to pay, and 15% of the respondents already pay for private healthcare.

A whopping 47% of respondents in the UK would be unlikely to pay for private healthcare or health insurance if they needed it. 23% of respondents said they’d be likely to pay, and 15% of the respondents already pay for private healthcare. Nearly half of respondents saying that wouldn’t invest in healthcare isn’t surprising considering that 29% of UK participants in 2022 said that they don’t switch their heating on because they can’t afford it. If people can’t afford to heat their homes, how can they afford to pay for private healthcare?

How Much of The UK Pays For Private Healthcare?

Only 10.6% of the UK population had private healthcare in 2020 (the last year this data is available), compared to 12.8% in 2000. In general, fewer people opted for private healthcare in recent years compared to 20 years ago.

How do UK residents who have private healthcare source the funds? The majority of respondents asked — 29% — said they used disposable income, and other responses included through a private healthcare scheme at work, using money from a savings account, taking out a loan, borrowing money from loved ones, and more.

The data shows that those with private healthcare range from 18 years old, with the 55+ group spending a mean of £3,244.32 on private healthcare in 2023, compared to £1,004.63 for the 18–24 age bracket.

The demographic of Private Healthcare users

Of those who own private healthcare, 56% are millennials and 60% are male. Most of those surveyed have a Bachelor’s degree, and 56% of owners have a “high” annual household income. Private healthcare owners are more likely to live in cities, and they consider a happy relationship and an honest and respectable life the most important aspects of life.

Reasons for Brits using Private Healthcare

There’s no denying that the NHS is under severe pressure, and until staffing issues are addressed, people are opting for a paid healthcare service for several reasons, with 57% of people in Britain signing up to private healthcare to be seen more quickly than with the NHS.

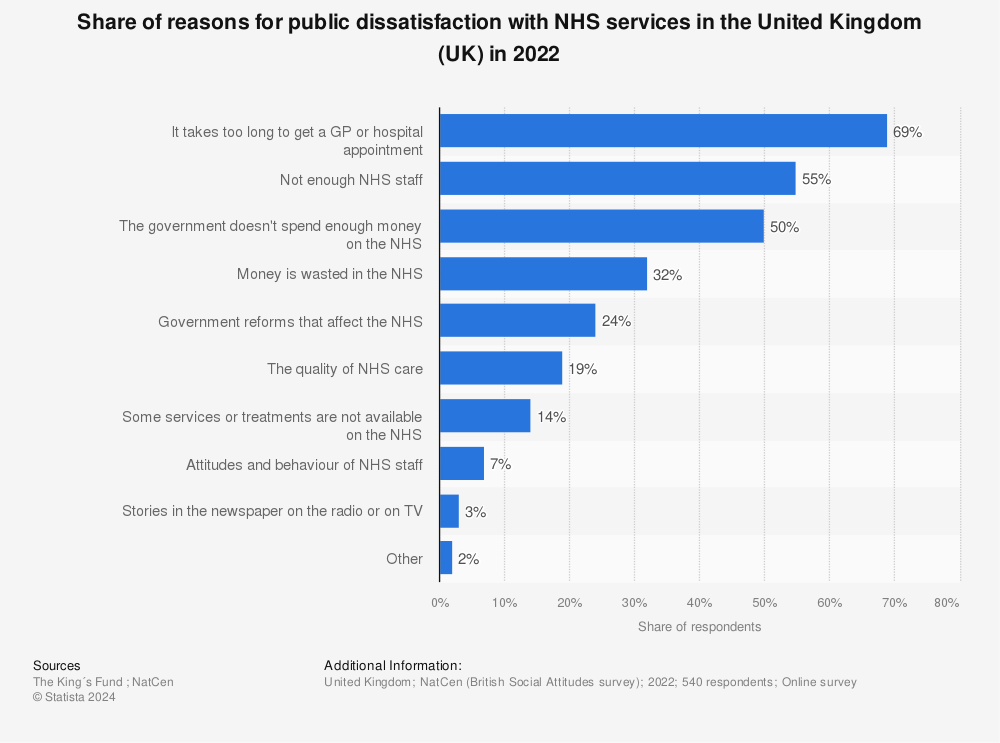

This data correlates with the biggest dissatisfaction the UK has with the NHS is waiting too long to get a GP or hospital appointment — with 69% expressing this disappointment.

Which UK Private HealthCare ProVider Has The Most Impressive Online Presence?

We looked at 8 UK private healthcare companies to see which to see which received the highest organic traffic, and Nuffield Health had over 800,000 organic searches in October 2023 — over 1.5 times as many searches compared to the previous year.

What does this mean? Hundreds of thousands of people in the UK are either considering private healthcare or are at least aware of the companies. Nuffield Health also had nearly 52.5 thousand Facebook followers in November 2023, implying that people are contemplating private healthcare or at least have an interest in these companies, perhaps due to other offerings.

Private healthcare facilities can focus on enhancing their domain authority to increase their online rankings for people searching for private healthcare — especially given that there is an interest from the public. Nuffield Health had the highest domain rating for Q4 2023 (a score of 77), and Aspen Healthcare is a private healthcare provider that had the lowest domain authority. Companies can implement a Digital PR and Outreach strategy to increase backlinks to increase their domain authority.

Get The Full Q1 2024 Report

The latest Q1 2024 benchmarking report for UK private healthcare companies has just been published. It covers the largest 8 UK private healthcare companies, including Spire Healthcare, Nuffield Health, Aspen Healthcare, Ramsay Healthcare UK, Circle Health Group, The London Clinic, Benenden Health, and HCA Healthcare UK. See a preview here.

If you have a private healthcare company and want to enhance your digital footfall, we can assist with your SEO and Content strategy, Conversion Rate Optimisation, Digital PR, Web Analytics and more. Browse our full website today for more detail about our marketing services.