August Round-up: Better Meta Targeting, Google Glitch & UX Best Practice

The latest version of our newsletter should have settled in your email inbox, detailing the need-to-know information and must-read thought leadership...

Read moreDr Dave Chaffey talks us through the best ways to understand audience intent, using a range of different digital tools and frameworks. Read more.

I've enjoyed helping businesses with their search marketing since the mid 1990s, since it so perfectly fits the essence of marketing, understanding customer needs and meeting them through content and products which fit these needs.

Since then, we've had more and more tools and insight to understand audience intent in Google and use it to improve our visibility and results. At one of our recent ClickThrough Marketing Masterclasses in Manchester, I was talking through with Jon de Weijer of Google, who was also speaking, about how different insight-based models have evolved to help simplify this search behaviour.

In this article, I'll look at some of the latest research showing how we can target emerging search behaviours and how this builds on previous thinking. I will also show how search relates to the RACE planning framework which we use at ClickThrough Marketing to inform our client discovery and planning on projects.

When considering investments in both paid and organic search marketing, it's always useful to start with your goals and review how you will measure whether they are achieved. It's best if these goals are as specific as possible and informed by insight. At ClickThrough we have developed a gap analysis approach to model consumer search intent (the number and types of searches) using the Google Keyword Planner and then compare that to your current paid and organic search. The latest improvements to Google Search Console make it much easier to compare month-on-month and year-on-year keyword and page-level performance.

To understand consumer intent and how to link this to performance, KPIs Google evangelist Avinash Kaushik developed his widely used See Think Do Care model in 2013: Do, Care Winning Combo: Content + Marketing + Measurement!

The audience for each stage is:

See: The largest, qualified, addressable audience. There is no commercial intent.

Think: The part of the audience that is actively thinking about or considering a particular product, i.e. showing some commercial intent.

Do: This stage is made up of that subset of the audience that is looking to buy.

This is effective in showing how different parts of the purchase funnel can be evaluated using measures available in Google Analytics . However, it is less effective in showing how this relates to search behaviour and specific outcomes on a site.

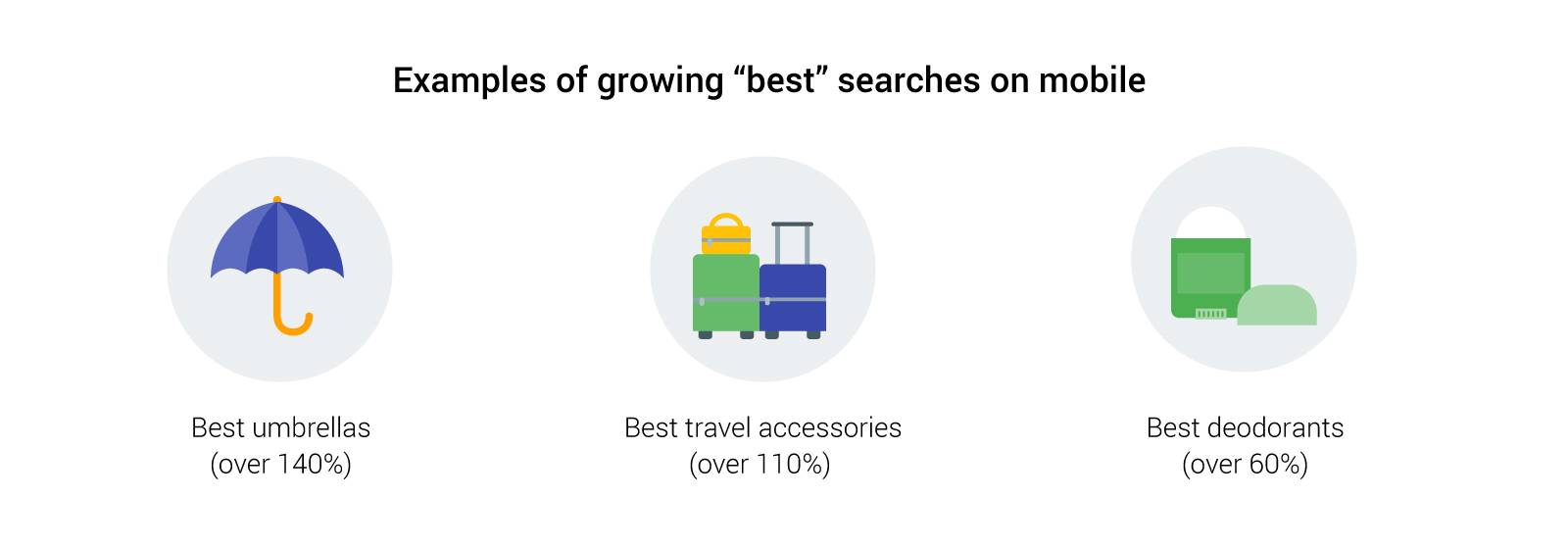

In 2015, I wrote on the ClickThrough blog about Google's micro-moments which highlighted need states at a point in time, particularly related for mobile:

Google also highlighted specific micro-moments around brand consideration and comparison, starting generic.

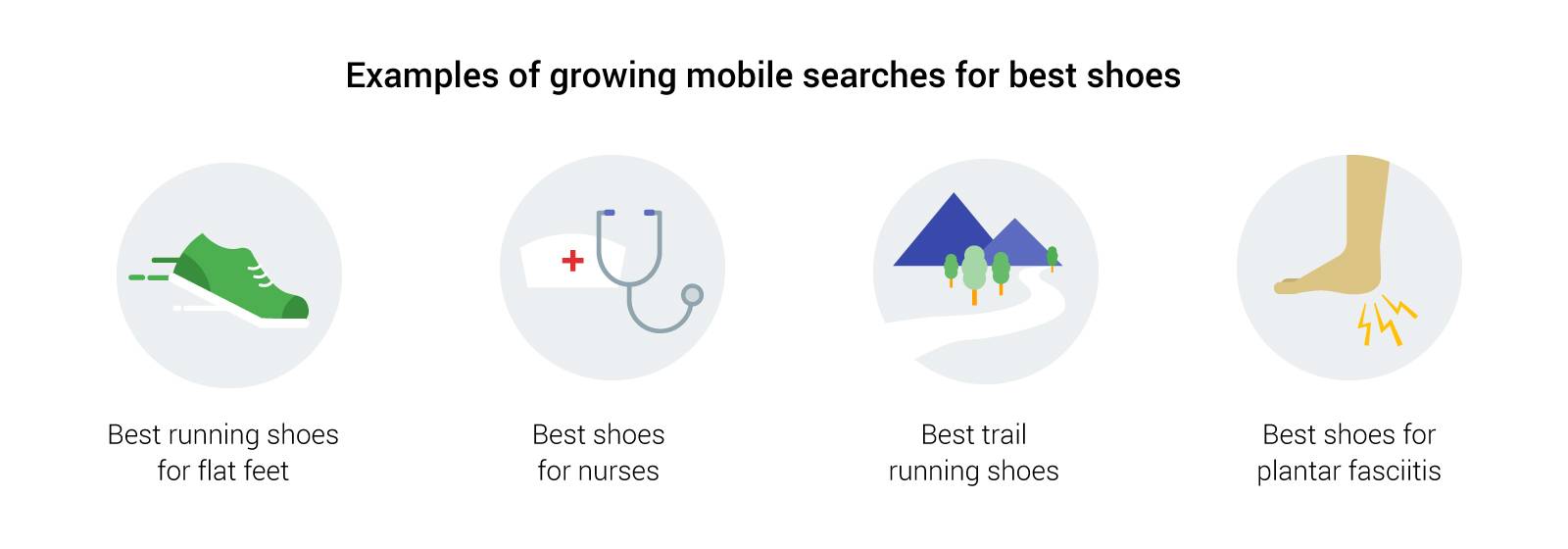

... and then narrowed in on a more specific need:

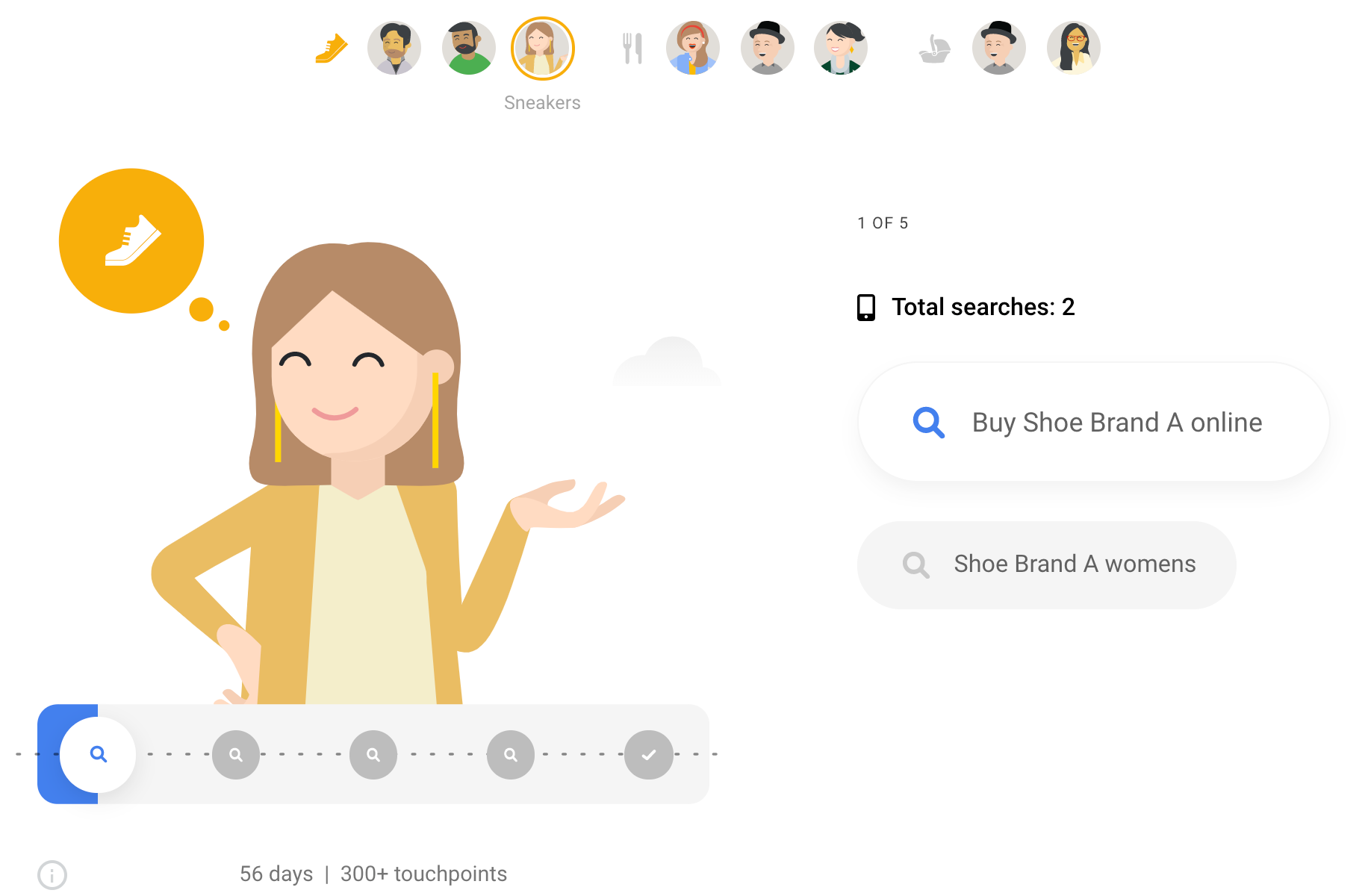

This is still a useful way to think about specific types of consumer intent, but the research didn't look at overall customer journeys, i.e. how the searches evolved through time. More recently, Google has invested in a lot of panel clickstream research summarised in this article on how search intent is redefining the marketing funnel. This looks at lots of examples of search journeys such as this, from Kate's journey to buy a pair of trainers which stretches over 56 days and some 300+ touchpoints.

This is still a useful way to think about specific types of consumer intent, but the research didn't look at overall customer journeys, i.e. how the searches evolved through time. More recently, Google has invested in a lot of panel clickstream research summarised in this article on how search intent is redefining the marketing funnel. This looks at lots of examples of search journeys such as this, from Kate's journey to buy a pair of trainers which stretches over 56 days and some 300+ touchpoints.

The main takeaways from this research is to prompt us to take a less linear view of search behaviour away from the traditional concept of marketing funnel with three stages: Awareness, Consideration, and Purchase.

Journeys may start with known brands, narrow in focus and then expand. Based on analysis of clickstream, Google says that "no two journeys are exactly alike, and in fact, most journeys don’t resemble a funnel at all; They look like pyramids, diamonds, hourglasses, and more".

Applying the Kantar Needscope model to search

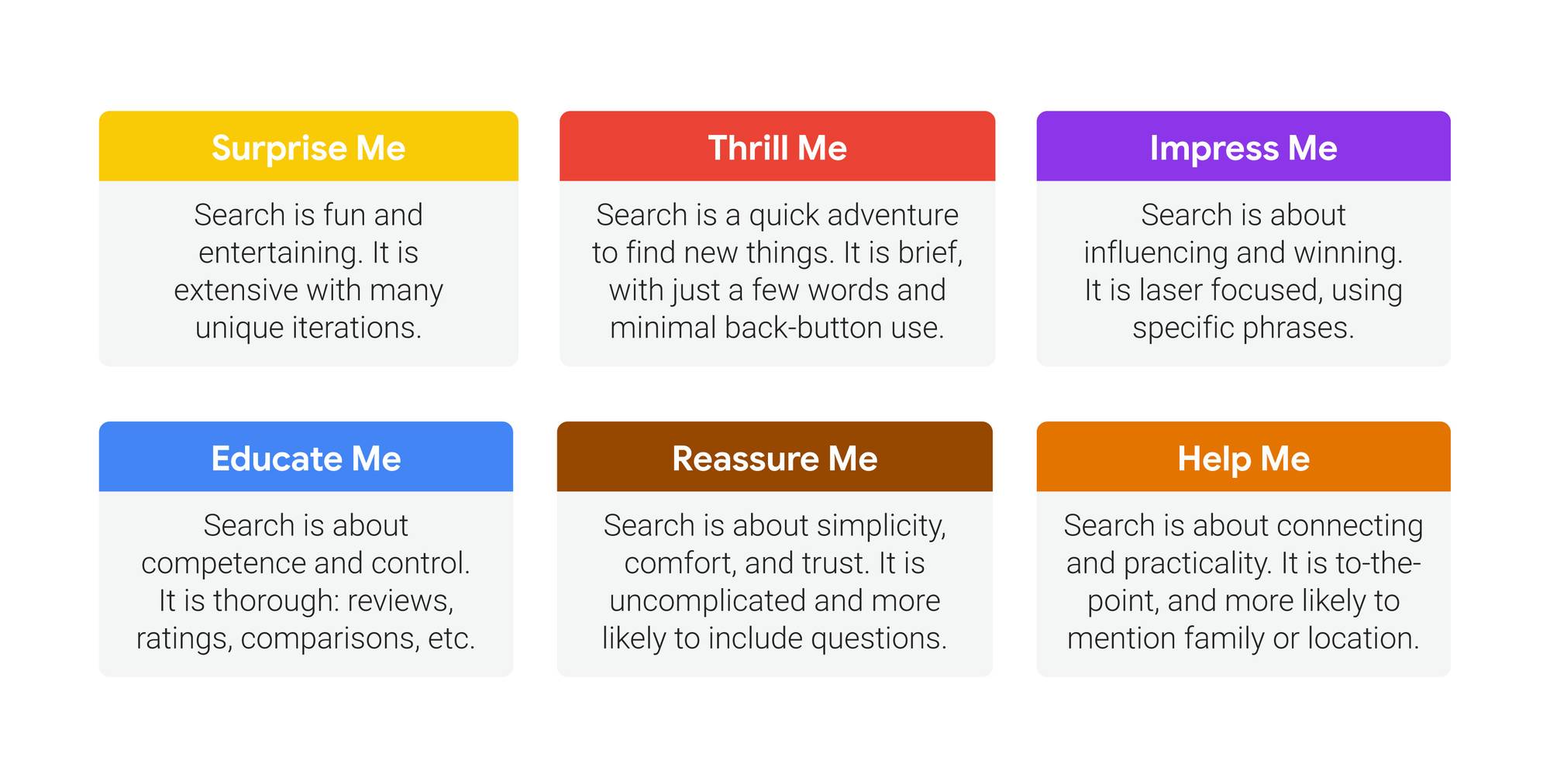

Kantar NeedScope was developed over 25 years ago to understand and measure emotion related to how consumes buy brands. Needscope evaluates six canonical consumer needs: “surprise me,” “help me,” “reassure me,” “educate me,” “impress me,” and “thrill me".

It is still used for auditing and improving brand effectiveness by answering questions like: Is my brand irresistible – and how can I improve its irresistibility? What are the greatest opportunities in my market – and how can I position my brand to take advantage? How can I optimise my brand or product portfolio? Are there unmet consumer needs my brand could be addressing? Can my brand stretch to new areas through innovation?

I mention Needscope since it featured recently in a Think with Google article: How Consumer Needs Shape Search Behaviour and Drive Intent. The Needscope research here is around how consumers consider Google as a brand, but is related back to search by this visual:

To me, applying the 6 needs states to search reminds us that search marketing is about creating an effective experience, regardless of the type of query. We should be thinking about the quality of web experience we deliver across all search queries, not just for the more commercial queries we traditionally focus on.

To me, applying the 6 needs states to search reminds us that search marketing is about creating an effective experience, regardless of the type of query. We should be thinking about the quality of web experience we deliver across all search queries, not just for the more commercial queries we traditionally focus on.

I developed the RACE digital marketing plan framework in 2010 to help give businesses a way to create integrated plans incorporating SMART objectives and a way to measure them. Compared to See, Think, Care it has more clarity on the business outcomes that we're looking to achieve at each stage:

Aimed at building awareness and visibility of your brand, products and services offsite on other websites and in offline media in order to build traffic by driving visits to different web presences like your main site, partner sites or social media pages.

Short for "Interact", Act is aimed at persuading site visitors or prospects to take the next step, the next action on their customer journey when they initially reach your site or social network presence. Kaushik calls actions "micro-conversions". For many businesses, the aim of Act is to generate online leads that can then be nurtured on the ‘path-to-purchase’.

The aim of conversion is to make the sale - either online or offline. This is supported by nurturing activities like ad or email retargeting and web personalisation to remind and persuade prospects about a brand plus assisted selling techniques when sales people are needed to reassure and answer prospect questions.

The aim of Engage is to achieve long-term customer engagement and advocacy using customer communications that is, developing a long-term relationship with first-time buyers to build customer loyalty as repeat purchases using communications on your site, social presence, email and direct interactions to boost customer lifetime value.

Since RACE covers the full customer lifecycle, it's useful to consider how search terms and paid activity vary through the customer lifecycle. Taking an example from the fashion sector, these are:

Using ads on the Google Display network can help deliver on Needscope states like "Surprise, Thrill, Impress and Educate me". This can generate interest beyond the usual targeting in Google search pages. it can also help develop a need leading to generic searches, e.g. "Latest fashion trends", Generic searches for types of clothing, e.g. "Women's winter jackets" perhaps qualified by known retailers or fashion brands.

Searches become more specific as people build out their consideration set of brands and search for more specific products in a category, for example "Women's winter jackets faux suede" again perhaps qualified by retailer or brand.

Long tail searches related to how, where and costs of buying plus known brands. These may be for brands "near me".

Searches existing customers may make will repeat searches from other parts of RACE, but often starting with a navigational search of <Brand> + "product/service".

Reviewing the evolution of models of consumer search behaviour shows the real-world complexity of how people search, and implies we should become more sophisticated in how we target. We should go beyond targeting simple generic product category and long-tail terms, but think about other search behaviours and how these evolve during the course of a purchase.

Applying RACE to search marketing planning alongside the other research we have covered helps emphasise the need for investment in display ads for demand generate, to create awareness of a need, develop their consideration list and then to remind consumers about brands they are interested through retargeting.

If you'd like to find out more about the RACE framework, and how to identify consumer needs within your own brand, get in touch with our experts today.

More articles you might be interested in:

The latest version of our newsletter should have settled in your email inbox, detailing the need-to-know information and must-read thought leadership...

Read more

Arming yourself with the right tools to ensure a smooth site migration is important - find out how to protect your SEO during a migration today.

Read more

As the cost of living continues to present challenges for many Brits, an increasing number of families are choosing to holiday within the United...

Read more

Our first curated newsletter has hit inboxes, detailing all of the latest need-to-know information and sharing all the necessary thought leadership...

Read more

Over the past few years, marketing leaders have been gearing up for the inevitable 'Cookieless Future'. Safari was the first to bid farewell to...

Read more

Google employees have recently announced that the upcoming Google Core Update is set to be released in the coming weeks. Understanding and addressing...

Read more

It only seems like yesterday that it was the winter of 2022 and we were balancing Black Friday and the Qatar World Cup. Fast forward to now and we're...

Read more

Language matters. Any marketer worth their salt knows this. But when discussing gender and sexual orientation, that importance is amplified tenfold.

Read more