With fast-fashion brands leading ahead of the traditional high street, will sustainability concerns affect the longevity of this success?

Rob Allen, Clothing & Fashion Specialist

We already know that digital-first brands are set to secure the biggest profits in the high street fashion sector over the next year. With the cost of living crisis, the uncertainty brought by the Covid-19 pandemic, and the closures of physical high street stores, FMCG fashion brands have boomed in popularity over the past five years, with Boohoo’s profits growing by more than 700% in this time period.

However, UK consumers are becoming increasingly conscious of the ethical impact of their clothing purchases, with sustainability becoming more of a priority when shopping for apparel.

Sustainability & ethics

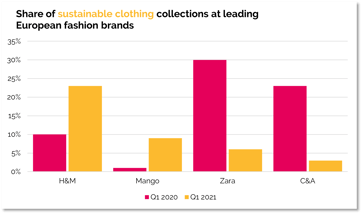

When expense is noted as the biggest barrier to buying sustainable fashion, fast fashion brands that are not focused on ultra-rapid stock turnover are best placed to offer a wider range of affordable clothing that is ethically conscious. H&M are a great example of this, with 23% of H&M’s collection being sustainable in 2021.

Source: Lectra via Statista

Source: Lectra via Statista

Equally, H&M are also able to apply this to the higher-end of high street retail with their more premium brands Cos and Arket fielding customers with a higher disposable income who are less focused on fast-fashion trends.

Digital first

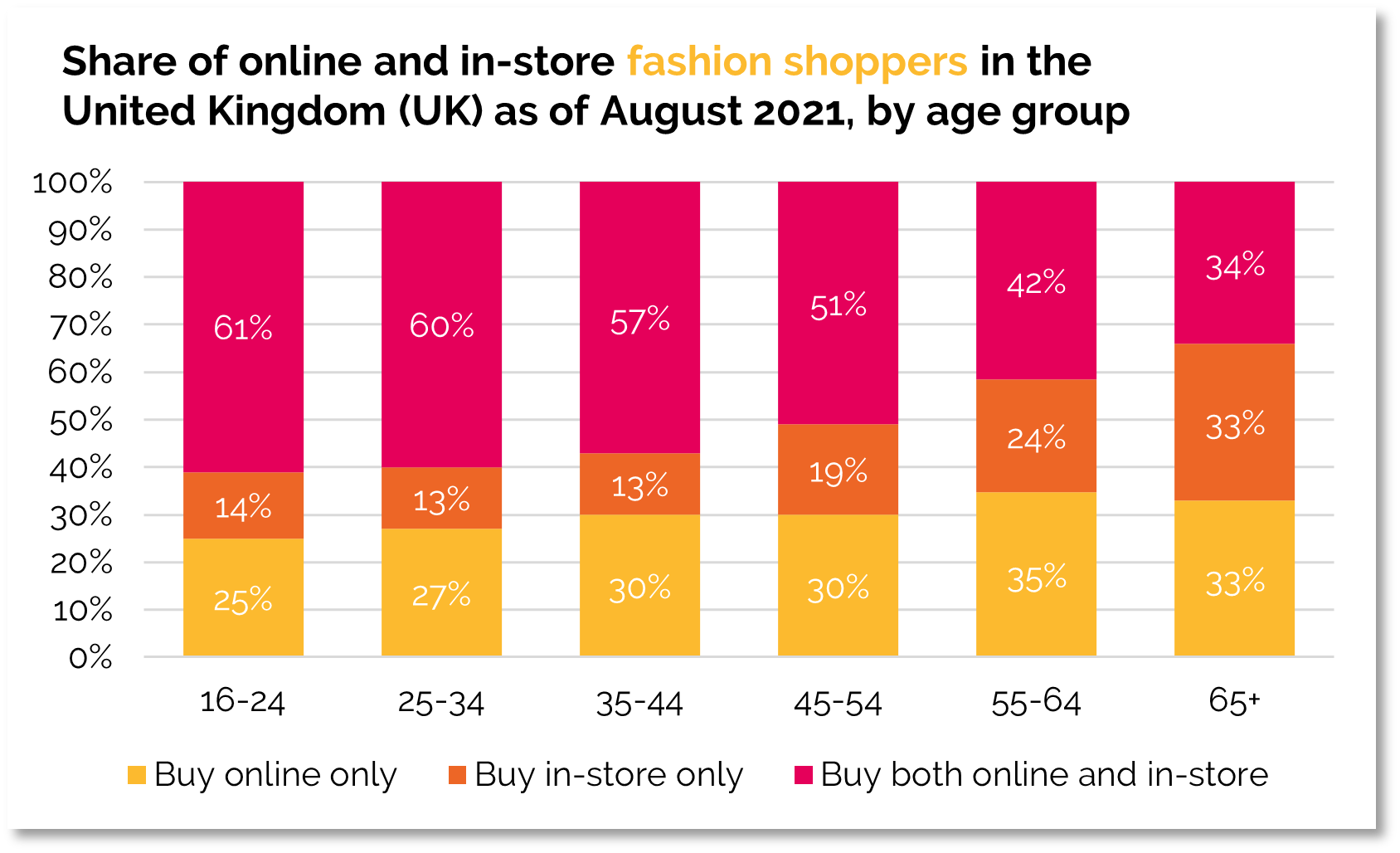

Though no FMCG fashion brands appear in the UK’s index of top sustainable brands, they are best positioned to benefit the most from the digital focus in younger consumers;

Source: Klarna; Savanta; TheIndustry.fashion via Statsista

Source: Klarna; Savanta; TheIndustry.fashion via Statsista

With mobile transactions making up 60% of all online purchases, brands that have always been online-only have been able to focus their attention on growing their digital footprint and perform well when it comes to dominating paid social media advertising. Many of these online-only brands, such as ASOS, Boohoo, and Missguided, even have their own apps which are ever-increasing in popularity and make browsing stock as easy as browsing social media itself.

When, as we’ve mentioned, cost is the biggest barrier to sustainable shopping, brands which can offer ultra-convenient shopping and shipping options can still comfortably count on business from price-conscious shoppers. If fast fashion brands were to move into adding sustainable lines into their stock that can be marketed as a more premium range, they’d be able to tick both the convenience and ethical boxes for consumers.

The second-hand market

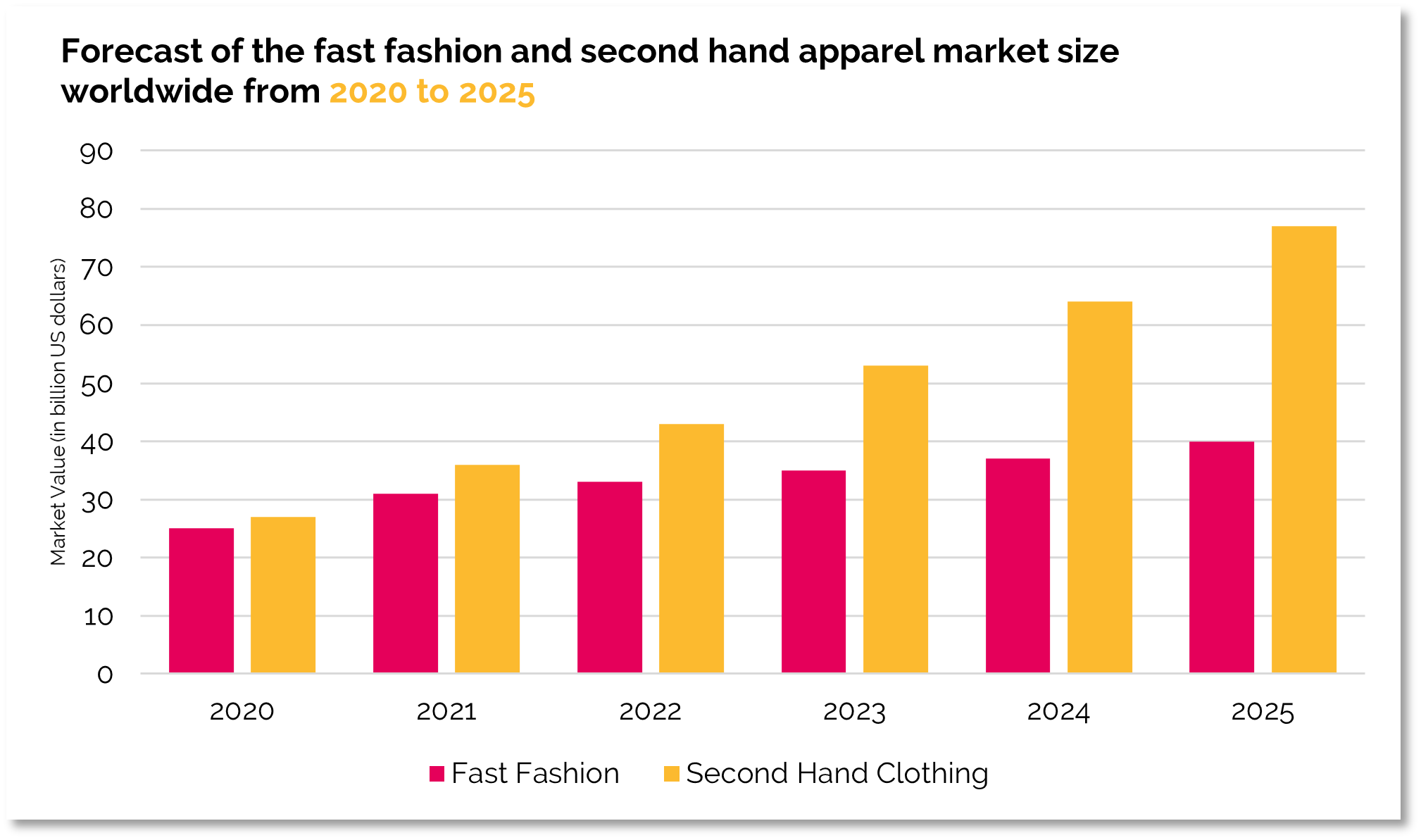

But, even with the introduction of ethical stock, fashion retailers’ profits may be under threat. Though we’re set to see significant growth in the fast fashion retail space, the gap between worldwide spending on second-hand clothes is set to widen significantly over the next three years.

Sources: Research and Markets; Statista; GlobeNewswire and GlobalData; Thredup

Sources: Research and Markets; Statista; GlobeNewswire and GlobalData; Thredup

This significant uplift is expected to go hand in hand with the rise of younger generations’ purchasing power. 42% of 18-37 year-olds are willing to buy second-hand apparel, due to it being a cheaper and more environmentally friendly way to afford premium goods. In line with this, the worldwide popularity of reselling app Depop has rocketed, with active Depop users rising by 107% between March ’20 and July ’20 (with it likely being no coincidence that this was the very peak of lockdown)!

For fast-fashion retailers, this poses specific challenges about how to appeal to this sense of responsibility from users. Brands might consider paying close attention to popular items within the reselling market, along with ensuring their eco-credentials are up to date and heavily promoted in their advertising.

While UK clothing buyers are becoming more ethically conscious, price will ultimately always be a sticking point for choosing sustainable fashion lines. With the secondhand market rising to meet both the sustainability and cost concerns of shoppers, fast fashion brands are faced with the need to act decisively if they want to keep up with the second-hand market.

GET THE FULL 70-PAGE Q2 2022 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on call 01543 410014 or schedule a call with Rob Allen.

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.