The Q2 2023 benchmarking report for UK home improvement brands has just been published. Learn how the top 12 UK home improvement brands perform across the digital space.

The latest Q2 2023 benchmarking report for UK Home improvement brands has just been published. It covers the largest 12 national home improvement brands, including Travis Perkins, Plumbworld, Screwfix, Tool Station, Wickes, Selco Builders, B&Q, City Plumbing, Homebase, Bradfords, Jewson and Wolseley.

The research gives an inside track on who is winning the biggest share of voice online, and quantifies the gaps, risks and missed opportunities for other home improvement brands to win brand exposure, and drive both online traffic and in-store footfall. The report highlights quick wins that will improve enquiries from your online strategy and identifies the barriers that may be reducing your site’s ability to optimise digital performance.

To see a preview and contents page of the Q2 report, click here. To get a copy of the full report and the key takeaways, please complete the enquiry form or schedule a call.

What The Industry Research Report Covers

The 70+ pages of research benchmarks each retailer based on 50+ metrics and indicators of successful digital strategy, including organic visibility, domain authority, paid media ads, conversion performance, technical performance, site speed, universal search, content, social ads, accessibility, and mobile performance.

Driving Optimal ROAS from Paid Media Channels

Some of the leading players in the space are high spenders on paid media channels such as Google, Bing & Facebook - but have a poor or sub-optimal conversion improvement strategy. Without an optimised, sophisticated conversion strategy that maximises the conversion rate, the return on investment is unsustainable or will underperform. Scaling spend on paid media is not achievable unless the conversion rate delivers optimal performance in the sector. Some in the space have paid media spend levels from 30k+ per month but dedicate minimal resources and budgets to conversion testing. Given the cost per clicks on ad networks will continue to rise, we recommend spending at least 10% of your paid media budget on ongoing conversion optimisation testing schedules to ensure your paid media ROI maintains long-term viability, competitive advantage, and sustainability.

Technical Website Compliance

Savvy digital marketers know that having a technically sound website is an essential component of a successful fully integrated digital strategy - plus a site capable of maximising conversion performance. For brands within the home improvement and DIY space, they'll often be supporting large websites hosting a huge range of products that regularly changes. Retailers will need to ensure that product and stock updates are well-considered within their internal linking strategy and that any changes do not impact the customer experience.

Since our last report, almost all our DIY and home improvement retailers have reduced their 4XX and 5XX errors to minimal levels. However, the exception still proved to be B&Q who have gone from showing 1,000 5XX errors in our last report, to 9,041 errors in Q2. As we've found a large amount of 5XX errors in both our past two reports, we'd advise B&Q to ensure their hosting servers are well-equipped to handle the size of their site.

Site Speed & Conversion Rate Performance

When 62% of consumers are less likely to convert if they have a negative mobile site experience, ensuring that your site is quick and easy to load makes a significant improvement on your overall conversion rates. DIY and home improvement sites should be well-equipped to handle last-minute, or on-the-go mobile searches from any customers searching for supplies mid-project.

In our last report, Jewson were the only brand even scoring an 'okay' score between 50-89. However, in Q2 Homebase and Screwfix passed this benchmark, leading the way with scores of 82 and 73 respectively. Though improving site speed will require thought and a strategic approach, once optimisations are deployed, this is a metric brands can instantly see improvements in, and outrun their competition.

Building Competitive Advantage with Domain Authority

Domain authority is an essential metric for measuring the effectiveness of SEO performance, and helps create a reliable overall gauge of how effective your site is at achieving organic traffic, i.e. ‘free’ traffic that isn’t gained through sponsored ads. Home improvement brands can look to collaborate with online trade publications or interior design bloggers in order to improve their DA, and ensure they're being linked to from high-authority sites.

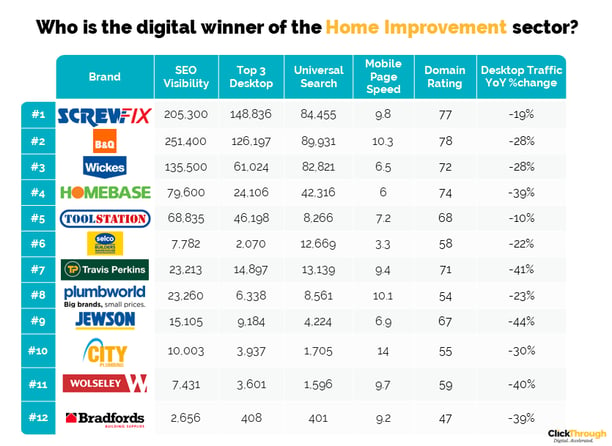

A ‘good’ DA really comes down to how your competitors are performing, however it’s generally considered average between 40 and 50, good between 50 and 60, and excellent above 60. As all our DIY and home improvement brands are long-standing companies, DAs are (unsurprisingly) high compared to brands in some of the more emerging sectors we work with. B&Q and Screwfix have the highest domain authorities, with 78 and 77 respectively.

Organic Performance – Mobile & Desktop

A strong organic performance is strategically important as it ensures your site ranks above competitors for key, transactional keywords. When 93% of your customers won’t go past the first page of Google, your absence or lack of targeting for essential keywords will cost you conversions. With our DIY and home improvement brands selling similar stock (with brand loyalty only going so far), strategic keyword optimisation is key to ensuring visibility is strong on high-conversion products and leading items.

Home improvement brands are still seeing reductions year on year, which is unsurprising due to the cost of living crisis squeezing the sector and forcing homeowners to postpone non-essential projects. However, with a shrinking pool of potential customers, brands must ensure they're not losing ground to one another within the space. Though Bradfords had seen the largest drop in traffic year on year in Q4, they've now reduced their loss of traffic to just -26% - the second smallest reduction in Q2. Other brands should be reviewing their traffic and keyword positions, to ensure their performance hasn't been impacted by Bradfords' success.

Universal Search Opportunity

Google Universal Search Results is an evolving opportunity to make your pages visible on a SERP (Search Engine Results Page). Universal results often appear before traditional listings and are eye-catching for users. Universal search results refer to rankings on a SERP that are not the traditional ‘blue line’ Google link, and a retailer can appear for universal search results without being strong in standard rankings. For any e-commerce brand, 'Reviews' are a useful way of building trust with prospective customers, and boost visibility on products. For home improvement brands, 'People Also Ask' provides an opportunity to rank for any DIY or construction queries too.

While 'Reviews' remained the most used Universal Search feature in the Home Improvement space, 'People Also Ask' is seeing a growing number of results, particularly from Screwfix who appeared for 14,300 'People Also Ask' results. Screwfix are well-placed to take advantage of high conversion-potential, longtail keywords, or questions about products, directly from the SERP.

The Longtail Keyword Opportunity

Longtail keywords are often considered high intent and potentially more likely to convert as a searcher is being more specific. Optimising for longtail keywords also puts your content strategy in a strong position to rank for retailer new search terms as they enter Google’s index. As we've mentioned, longtail keyword rankings put brands in good stead for appearing in 'People Also Ask' search results, so have the added benefit of boosting Universal Search visibility too.

As expected from their performance in Universal Search, Screwfix are appearing in the top 3 results for the most longtail keywords across all our home improvement brands, with a total of 111,902. However, B&Q are ranking for more longtail keywords overall, with far more appearing in positions 4-10. Screwfix must ensure they continue to monitor and optimise for these high-potential keywords, so they can continue to outrank their close competitor.

Facebook Adverts

With the number of Facebook users in the United Kingdom (UK) forecast to hit over 42 million users by 2022, it is not surprising that companies have jumped at the opportunity to advertise on the social media platform. Facebook’s UK digital advertising revenue has been estimated to have breached 2.6b GB pounds in 2019.

Selco Builders have used Facebook ads to ensure their bank holiday opening times are well-advertised and that potential customers know they are available for supplies. They've also used the platform to advertise special deals and promotions on spotlighted products. Flash events such as these are a great way to harness Facebook advertising, as ad campaigns will ensure that visibility is achieved quickly, and can simply be switched off when no longer relevant.

Top Social Shares & Content

When it comes to social media and on-site content strategies, it is important to release content that has a longer shelf life. An article is considered 'Evergreen' if it has maintained its relevancy to an audience for longer. It's great for your retailer engagement, but great for Google too, who will recognise content which achieves traffic over a long period of time. For DIY and home improvement stores, they'll have two audiences - at-home DIYers and trade professionals. This presents the opportunity to create two distinct content plans, that can appeal to a wide range of potential customers.

Travis Perkins, Wickes, B&Q, and Homebase are all using Pinterest to share their content (most predominantly). Pinterest is a brilliant platform for targeting at-home DIYers who are looking for inspiration on home improvement projects and interior design. Pinterest's in-built shoppability feature also helps funnel users directly from the inspiration and consideration phases, down through the funnel to ultimately converting. These four brands are well-placed to be front-of-mind for their customers' entire buying journey.

Website Readability & Accessibility

20% of people in the UK have a disability – 2 million of which are people living with sight loss. In addition, 1 in 12 men and 1 in 200 women have some degree of colour vision deficiency. When websites are not designed to meet these needs, retailers lose customer interest as they turn elsewhere. As with ensuring their sites are technically compliant, large e-commerce brands, such as those in the home improvement sector, should ensure that their site is simple to read and digest, as well as navigate.

Plumbworld have made no progress on accessibility since Q4, as our audit still showed 558 contrast errors in Q2. Contrast errors such as these make sites difficult for those with colour vision deficiencies to read, and Plumbworld should be reviewing their branding usage to ensure nothing in their colour palette could be causing these barriers to accessiblilty.

Q2 2023 WINNERS LEADERBOARD

For a glance into just 6 of the metrics, we evaluated these top 12 home improvement brands on, check out our quick-look table below;

GET THE FULL 70-PAGE Q3 2023 REPORT

To get a copy of the full report, please complete the enquiry form. If you want to talk to us about accelerating your digital performance, please call us on 01543 410014 or schedule a call with Mike Movassaghi.

Photo by Sam Clarke on Unsplash

Let's be social

Join our growing social communities to learn more about the benefits of digital marketing and the people who make us tick.