August Round-up: Better Meta Targeting, Google Glitch & UX Best Practice

The latest version of our newsletter should have settled in your email inbox, detailing the need-to-know information and must-read thought leadership...

Read moreUnderstanding consumer psychology and the changes in peoples’ spending habits can be the key to creating a recession marketing strategy.

With inflation hitting record levels and the Bank of England expecting the UK to fall into the longest recession since records began, the outlook is expected to be incredibly challenging over the next two to three years. This can lead to companies making less money, decreases in salaries and rises in unemployment, and as marketers, whose job is to encourage consumers to buy our clients’ products and services, a recession makes this all the more challenging.

During these economical events, we need to review our strategies based on the data and insights we have. If we know how consumers spending habits are likely to change during a recession, how can we use this information to our advantage?

A report by John Quelch and Katherine Kocz has studied recessions since the 1970s to profile consumer behaviour and consumption patterns. As we see consumers reduce spending, this usually leads to a drop in marketing budget - but by failing to understand consumer psychology and the difference in their core needs during a recession, strategies aren’t adapted and the existing demand is not capitalised on.

As we move into a recession, it is important to remember that although purchases depend on cost as a bottom line, it can also be impacted by things such as trusting a business, the future impact and embracing elements of lifestyle. This means that although it is a challenge to market in a recession, it’s not impossible, and the first thing to review is the new customer segments that tend to emerge.

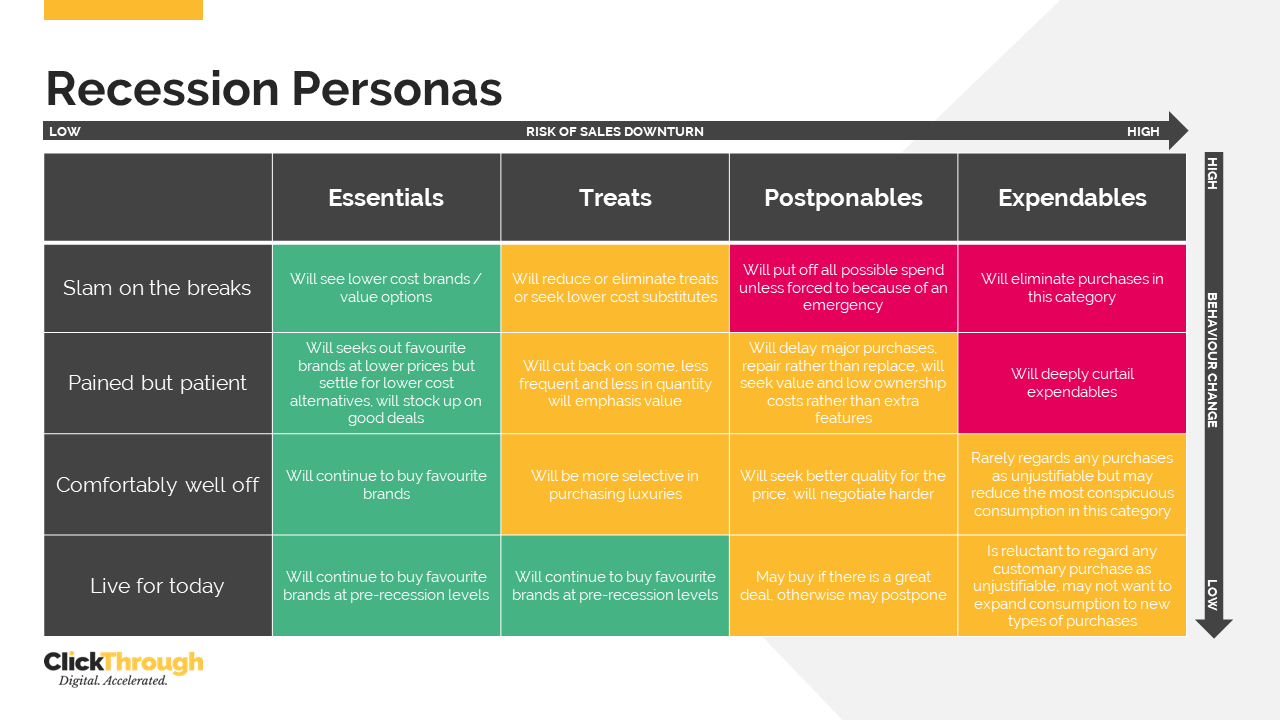

During a recession, consumers tend to fall into the following four categories:

Slam on the breaks

Exactly as it sounds, these are people who cut all spending that’s unnecessary during a recession. This category of consumers feels the impact of the recession most deeply and will reduce all spending by stopping, postponing, or substituting purchases for the entirety. On average, this usually includes low-income households, but it can also include those higher-income households if circumstances change during this time.

Pained but patient

As the largest segment, the majority of households fall into pained but patient. These people tend to feel optimistic about the future but worry about the shorter term and being able to keep consumption habits stable. While there is some reduction here, it’s at a much less dramatic level than those in slam on the breaks. The segment covers a wide range of incomes and isn’t typically impacted by unemployment, but the longer a recession goes on, the more this category moves over to the slam on the breaks section.

Comfortably well-off

Usually consisting of the top 5% of the income bracket, those in this category feel safe about riding out the recession, with little to no change to their spending, alongside those who have less wealth but have investments or savings and feel comfortable with the situation.

Live for today

These people tend to carry on spending as usual and don’t particularly worry about the recession, saving or spending. They may extend timeframes for making big purchases, but as they are younger, typically rent and spend money on experiences, this will likely continue and only change if their employment status changes.

Demonstrating these four segments only tells half of the story, as we know how consumers will change their spend, but the other half is made up of the product itself, so we also need to profile consumption by outlining four categories:

Where these categories really come into their own is when they are used with business intelligence to make marketing decisions. By understanding consumer psychology, they can be categorised, as a percentage, into each of these segments. The product or service can also then be categorised into a consumption level and based on this, brands can model where spending will continue, where it will slow down and where it will stop.

This means that with marketing budgets shrinking and cost-cutting happening across the board, it provides a tangible area of where marketing support is still needed and where it can be prioritised.

The green areas

The green areas represent a stable market, where a change isn’t likely to happen, so a change in strategy doesn’t need to happen and activity can run as planned. It also means there are less opportunities within this market, so the incremental wins most typically come from messaging and creative.

The red areas

The red area is where consumer spending will stop or hugely decrease, so spending marketing budget here needs to be thought about more carefully. This represents a declining market with a reduction in opportunities for brands, so although it may be tempting to stop spending there, it is an indication that brands need to be more tactical here, investing more smartly and focusing on benefits that are important to users in these segments.

The yellow areas

The yellow area is the sweet spot, where people will continue and can be convinced to keep purchasing, so this is where the bulk of the strategy can come into play.

This is a mixed market, where there are opportunities in some areas and not in others, depending on the profile. You can think smarter about how to capture people’s attention, the message you want to share and the products and services that can produce the incremental gains, even during a recession. By balancing your activity across these three areas, it can allow you to use your marketing budget more tactically, ensuring your focus is on the areas where the most opportunity is, while balancing with remaining visible for a future time period – inevitably coming out of the recession. Whether using this framework or another, during a recession it is critical to profile your customers and review their change in priorities and value in order to align with these as much as possible.

If you’d like to chat to our experts about recession frameworks, consumer spending and how you can implement this into your marketing budgets, contact us now.

Photo by Mathieu Stern on Unsplash

More articles you might be interested in:

The latest version of our newsletter should have settled in your email inbox, detailing the need-to-know information and must-read thought leadership...

Read more

As the cost of living continues to present challenges for many Brits, an increasing number of families are choosing to holiday within the United...

Read more

Our first curated newsletter has hit inboxes, detailing all of the latest need-to-know information and sharing all the necessary thought leadership...

Read more

Over the past few years, marketing leaders have been gearing up for the inevitable 'Cookieless Future'. Safari was the first to bid farewell to...

Read more

It only seems like yesterday that it was the winter of 2022 and we were balancing Black Friday and the Qatar World Cup. Fast forward to now and we're...

Read more

There are many factors to consider when choosing an automotive dealership, with 53% of customers saying that price determines which dealership they...

Read more

Which UK-based private healthcare providers are running away with their digital presence and who needs a helping hand to take the next step? How is...

Read more

How prepared are you for planning & budgeting season? Dave Chaffey shares some of the questions you should ask yourself when planning marketing...

Read more